Which Of The Following Is A Type Of Electronic Payment

Electronic payment methods have revolutionized the way we conduct financial transactions. With the rise of technology and the increasing popularity of online shopping, electronic payments have become an essential part of our daily lives. From credit cards to mobile wallets, there are various types of electronic payment methods available today. In this article, we will explore some of the most common and widely used electronic payment options.

Credit and Debit Cards

Credit and debit cards are perhaps the most well-known and widely used electronic payment methods. These plastic cards allow consumers to make purchases by electronically transferring funds from their bank accounts or credit lines to the merchant’s account. Credit cards provide a line of credit that allows users to borrow money for purchases, while debit cards deduct funds directly from the user’s bank account.

With the advancement of technology, credit and debit cards have evolved to include features such as contactless payments, where users can simply tap their cards on a payment terminal to complete a transaction. This convenience has made credit and debit cards a popular choice for both online and offline transactions.

Mobile Wallets

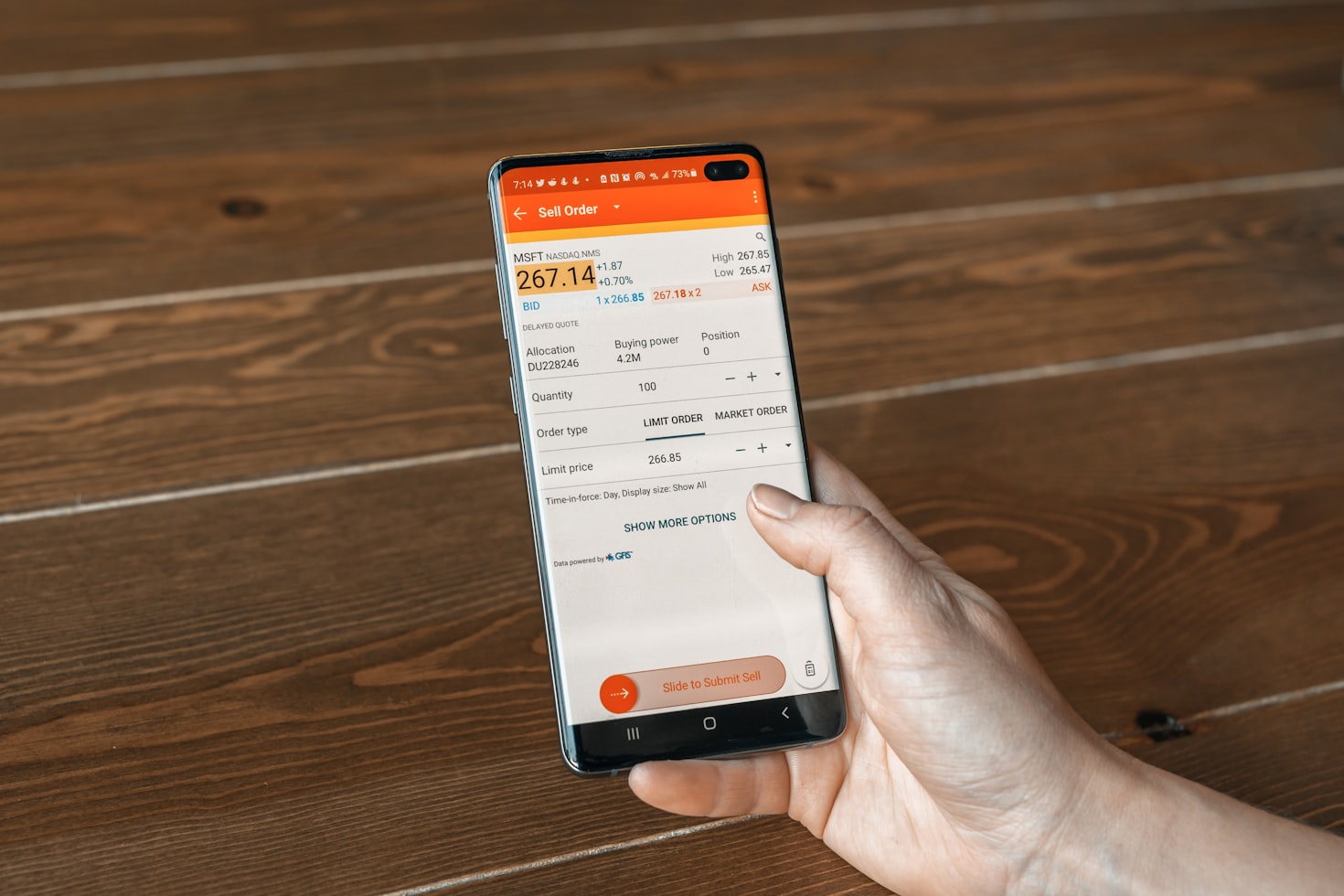

Mobile wallets have gained significant popularity in recent years. These digital wallets allow users to store their credit card, debit card, or bank account information on their smartphones. By linking their payment methods to the mobile wallet app, users can make payments by simply tapping their phones on a payment terminal or scanning a QR code.

Popular mobile wallet apps include Apple Pay, Google Pay, and Samsung Pay. These apps provide a secure and convenient way to make payments without the need to carry physical cards. Mobile wallets also offer additional features such as loyalty program integration and the ability to split bills with friends, making them a versatile and user-friendly payment option.

Online Payment Gateways

Online payment gateways are essential for e-commerce websites and online businesses. These gateways act as intermediaries between the customer, the merchant, and the financial institutions involved in the transaction. When a customer makes a purchase online, the payment gateway securely processes the payment information and transfers the funds from the customer’s account to the merchant’s account.

Popular online payment gateways include PayPal, Stripe, and Square. These platforms offer a range of features such as fraud protection, recurring billing, and international payment support. Online payment gateways have played a crucial role in enabling the growth of e-commerce by providing a secure and seamless payment experience for customers.

Cryptocurrencies

Cryptocurrencies, such as Bitcoin and Ethereum, have emerged as a new form of electronic payment. These digital currencies use cryptography to secure transactions and control the creation of new units. Cryptocurrencies offer a decentralized and transparent payment system that bypasses traditional financial institutions.

While cryptocurrencies are still relatively new and not widely accepted, they have gained attention for their potential to revolutionize the financial industry. Some businesses and online platforms have started accepting cryptocurrencies as a form of payment, and there are even dedicated cryptocurrency payment processors that facilitate these transactions.

Prepaid Cards

Prepaid cards are another type of electronic payment method that has gained popularity in recent years. These cards are loaded with a specific amount of money and can be used for purchases until the balance is depleted. Prepaid cards are often used as an alternative to traditional bank accounts or credit cards, especially by individuals who may not have access to these financial services.

Prepaid cards can be used for both online and offline transactions, making them a versatile payment option. They are also a popular choice for budgeting and controlling spending, as users can only spend the amount loaded onto the card.

Summary

Electronic payment methods have revolutionized the way we make transactions, offering convenience, security, and flexibility. From credit and debit cards to mobile wallets, online payment gateways, cryptocurrencies, and prepaid cards, there are various options available to suit different needs and preferences.

As technology continues to advance, we can expect further innovations in electronic payment methods, making transactions even more seamless and secure. Whether you’re shopping online or making in-store purchases, electronic payments have become an integral part of our daily lives.

Frequently Asked Questions (FAQ)

-

1. Are electronic payments secure?

Yes, electronic payments are generally secure. Payment methods such as credit cards and mobile wallets use encryption and tokenization to protect sensitive information. However, it is important to follow best practices such as using strong passwords and keeping your devices updated to ensure the security of your electronic payments.

-

2. Can I use electronic payments for international transactions?

Yes, many electronic payment methods support international transactions. Credit cards, online payment gateways, and some mobile wallets offer international payment capabilities. However, it is advisable to check with your payment provider for any specific restrictions or fees associated with international transactions.

-

3. Are cryptocurrencies widely accepted?

While cryptocurrencies have gained popularity, they are still not widely accepted as a form of payment. However, the acceptance of cryptocurrencies is growing, and some businesses and online platforms now accept them. Additionally, there are cryptocurrency payment processors that facilitate transactions between cryptocurrencies and traditional currencies.

-

4. Can I use prepaid cards for online shopping?

Yes, prepaid cards can be used for online shopping. Many prepaid cards are issued by major payment networks such as Visa or Mastercard, allowing them to be used wherever these networks are accepted. However, it is important to check the terms and conditions of the specific prepaid card to ensure it can be used for online transactions.

-

5. Are there any fees associated with electronic payments?

Some electronic payment methods may have associated fees. For example, credit cards may have annual fees or interest charges if the balance is not paid in full. Online payment gateways and mobile wallets may charge transaction fees or percentage-based fees for processing payments. It is important to review the terms and conditions of each payment method to understand any applicable fees.

-

6. Can I use multiple electronic payment methods?

Yes, you can use multiple electronic payment methods based on your preferences and the acceptance of different methods by merchants. For example, you can use a credit card for online shopping, a mobile wallet for in-store purchases, and a prepaid card for budgeting purposes. It is important to ensure that the payment methods you choose are accepted by the merchants you wish to transact with.

In conclusion, electronic payments have transformed the way we conduct financial transactions. From credit and debit cards to mobile wallets,